Goods and Services Tax (GST) in India: Failed Promises and lagging govt Revenue

Last Updated: 12 May 2024

India in a loss when compared to pre-GST era?

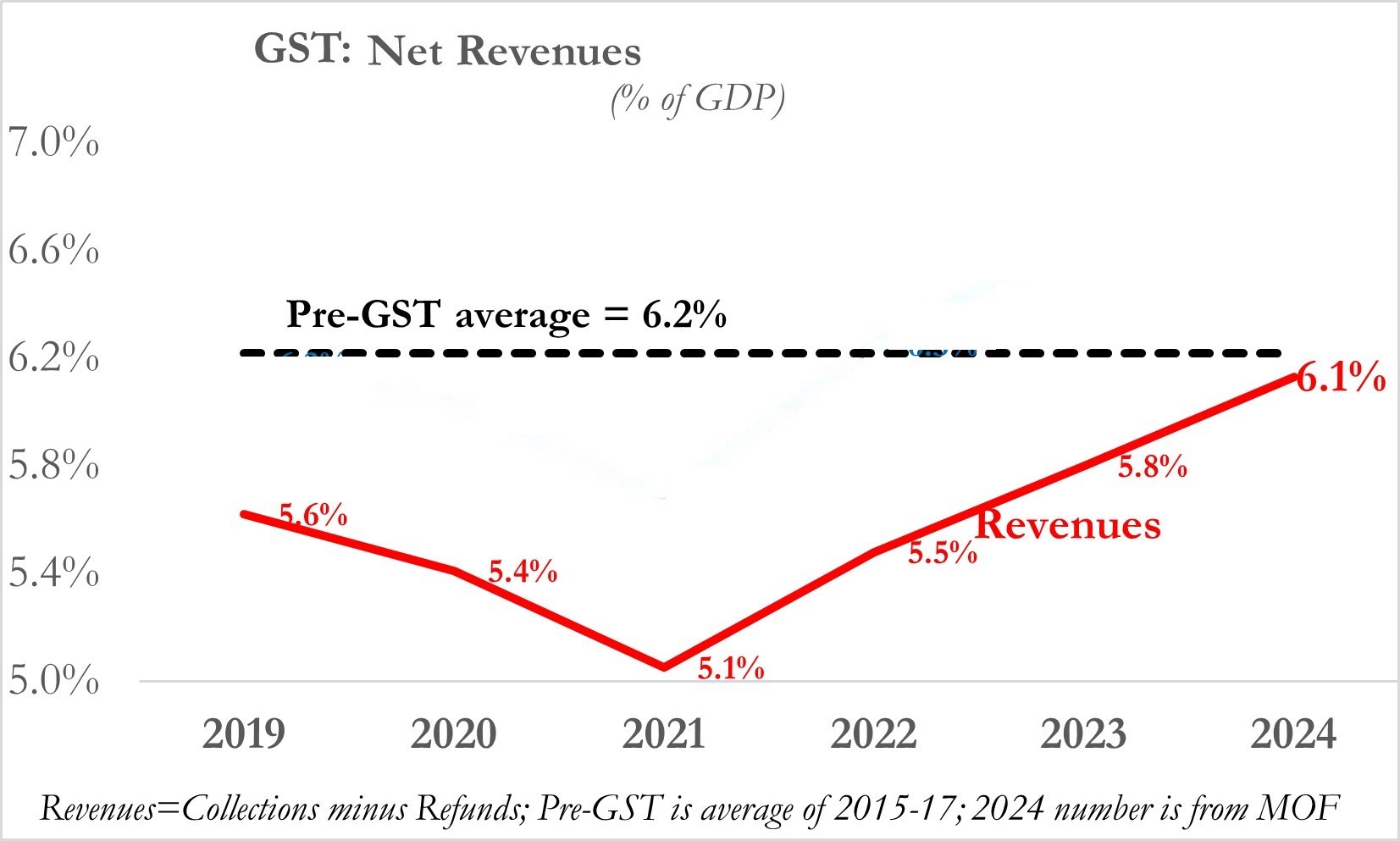

Compared to the pre-GST regime, the revenue collected from GST, as a percentage of GDP, continues to be lower

¶ GST failed?[1]

| The 15th Finance Commission has cited | |

|---|---|

| Revenue Neutral Rate | 15.5% |

| Average GST rate | 11.8% |

¶ Total Revenue pre-GST vs post-GST[2]

Focus must be on revenues, net of refunds; not on headline collections

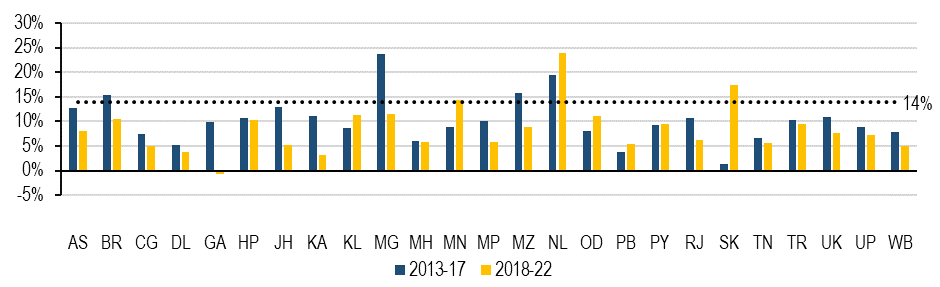

¶ State Revenue pre-GST vs post-GST

Revenue growth for many states was higher in the pre-GST regime[3]

¶ Promises at Launch, embarrassments now?[4]

- Indians were told that GDP would increase by 1-2 % points

- States were told that their tax revenues, as a proportion of their GSDP

- which had been in decline since about 2010 would not just be arrested

- And tax revenues would actually increase by 2% points

- Indian consumers were told that these moves would actually result in prices going down by about 10%

- Modi promised in 2017 of liberation from the menace of “tax terrorism”

¶ What is GST?[3:1]

3rd August 2016: Constitution 122nd Amendment Bill passed by Rajya Sabha[5]

1st April 2017: GST applicable across India, launched with a midnight parliament session among much fanfare[5:1]

GST introduced two key changes in India’s indirect tax regime:

- The principle of taxation changed:

GST is collected at the destination while the earlier tax was collected at the source - GST subsumed a number of central & state taxes:

Central level: central excise duty, service tax, and central sales tax

State Level: Sales tax, entertainment tax, and octroi

GST tax threatens the foundational values of federalism but states gave up their tax sovereignty in the larger interest of the country and taxpayers[1:1]

References:

https://www.newindianexpress.com/opinions/editorials/2022/jun/27/afterfive-yearsof-gst-some-hitsand-many-misses-2470180.html ↩︎ ↩︎

https://www.business-standard.com/opinion/columns/understanding-gst-revenue-performance-124010101030_1.html ↩︎

https://prsindia.org/budgets/states/policy/state-of-state-finances-2022-23 ↩︎ ↩︎

https://frontline.thehindu.com/economy/goods-and-services-tax-gst-five-years-faulty-by-design/article65599241.ece ↩︎

https://advanta.io/learn/complete-guide-goods-services-tax-gst-india/gst-india-story-far/ ↩︎ ↩︎

Related Pages

No related pages found.