Tax increased on Poor, Corporate/Rich benefitted & Middle class feeling dual pinch

Last Updated: 01 May 2024

For Corporate/Rich, banks have written-off a massive INR 11 lakh crore in non-performing assets (bad loans) over the preceding six financial years

¶ Taxes[1]

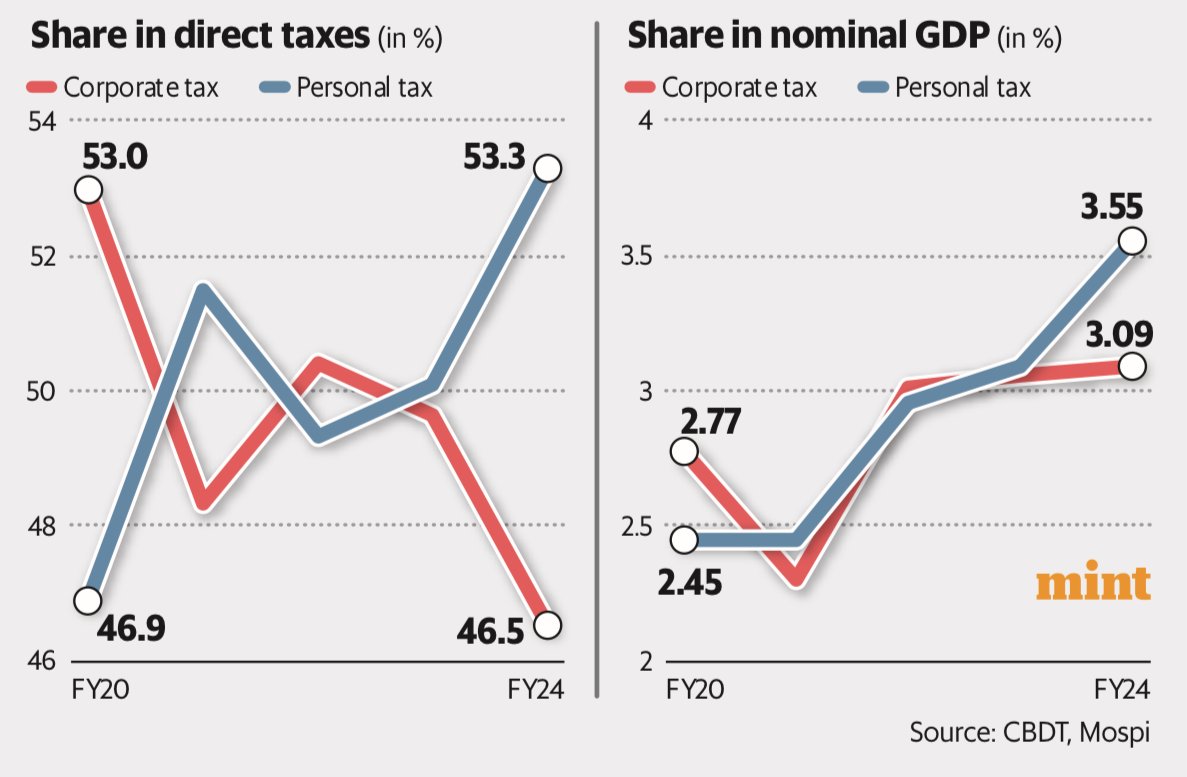

The burden of taxation has gradually shifted away from the corporates towards the individual income taxpayer

For every Rs 100 tax collected[2](Updated Jan 2024)

Modi government took roughly Rs42 from poor, Rs 26 from the middle class, and only Rs26 from rich

Manmohan Singh government collected Rs28 from poor and Rs 38 from rich

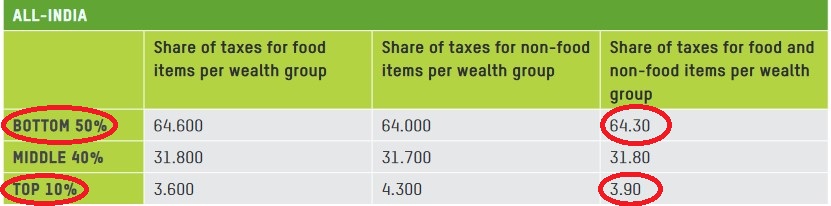

¶ Oxfam Report 2023

->Bottom 50% (i.e. Poorest) pay 64.30% share of tax

->Top 10%(i.e. Richest) pay only 3.90% share of tax

¶ Direct Taxes[3]

¶ a. Deduced tax on Corporate

- In 2019, the Central Government reduced the corporate tax slabs from 30 per cent to 22 per cent, with newly incorporated companies paying a lower percentage (15 per cent)

- These tax cuts resulted in corporate tax collections declining by approximately 16 per cent in their first year

In first two years of corporate tax cut, govt suffers Rs 1.84 lakh crore loss[4]

Companies used the tax savings to either pay off their debts or boost their profits, without even a single penny rise in net investment[1:1]

¶ b. Increased tax burden on the poor

- To increase revenue, following the shortfall from Corporate Tax, the Union Government adopted a policy of hiking GST rates while simultaneously cutting down on exemptions

- Between 2014-15 and 2021-22, the excise duties on petrol increased by 194 per cent, while the excise duties on diesel were hiked by 512 per cent

The indirect nature of both the GST and fuel taxes make them regressive, which invariably burdens the most marginalized

Since 2020-21, the share of indirect taxes in the state exchequer has risen by 50%

¶ Dual Pinching of Middle & Lower Middle Class[1:2]

- In order to reduce inflation, the Reserve Bank increases the repo rate i.e. directly reflects in increasing loan rates

- Given that 90 per cent of those taking home loans in India bought houses in the “affordable” segment (below INR 35 lakhs)

i.e. lower and middle-income households suffer dual-duress of increase in loan payments and price rises

References:

https://d1ns4ht6ytuzzo.cloudfront.net/oxfamdata/oxfamdatapublic/2023-01/India Supplement 2023_digital.pdf?kz3wav0jbhJdvkJ.fK1rj1k1_5ap9FhQ ↩︎ ↩︎ ↩︎

https://www.deccanherald.com/opinion/what-if-rama-asks-if-the-tenets-of-ram-rajya-are-being-followed-2857906 ↩︎

https://www.livemint.com/economy/personal-income-tax-now-does-the-heavy-lifting-in-direct-tax-collections-11715169966612.html ↩︎

https://www.newindianexpress.com/business/2022/aug/14/in-first-two-years-of-corporate-tax-cut-govt-suffers-rs-184-lakh-crore-loss-2487445.html ↩︎

Related Pages

No related pages found.